Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then

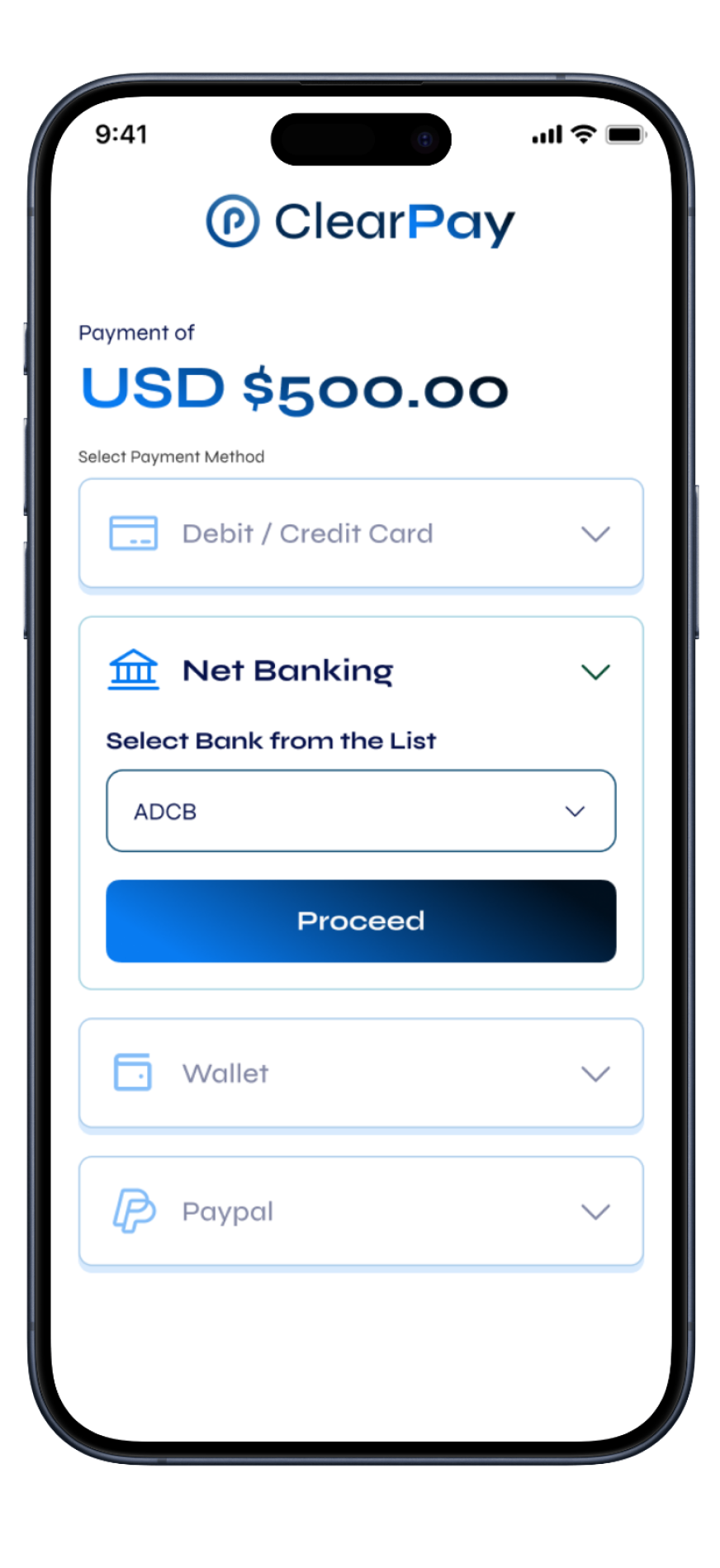

Streamline your online payments with our advanced payment gateway solutions. Whether you’re a startup or an enterprise, we offer secure and efficient services to manage all your transactions effortlessly.

Effortlessly manage customer payments globally with our payment gateway.

Boost conversions and enhance profitability by providing each customer with a tailored payment experience

Streamlines system connections, reducing development time and costs

We excel in providing specialized payment processing services tailored specifically for high-risk industries.

Whether you’re in need of merchant accounts, chargeback management, or fraud prevention strategies, our team is dedicated to delivering reliable support and innovative solutions that meet your business objectives.

Our payment services are tailored to your specific business needs.

Keeping your transactions safe is our top priority

Efficiency is key in today’s fast-paced market.

Reduce costs, boost revenue, and simplify your operations with our unified platform. Leverage intelligent routing, advanced reconciliation, dynamic reporting, and more to overcome challenges and elevate your business.

Process transactions online, or through your platform.

Accelerate your business with automated revenue and financial systems.

Integrate financial services into your platform or product.

Make payouts and handling transactions effortless as your business progresses through different growth phases.

Explore our comprehensive digital banking solutions designed to streamline your financial activities and enhance your banking experience.

For startups and growing companies

For mid-sized companies looking to scale

For global enterprises with custom needs

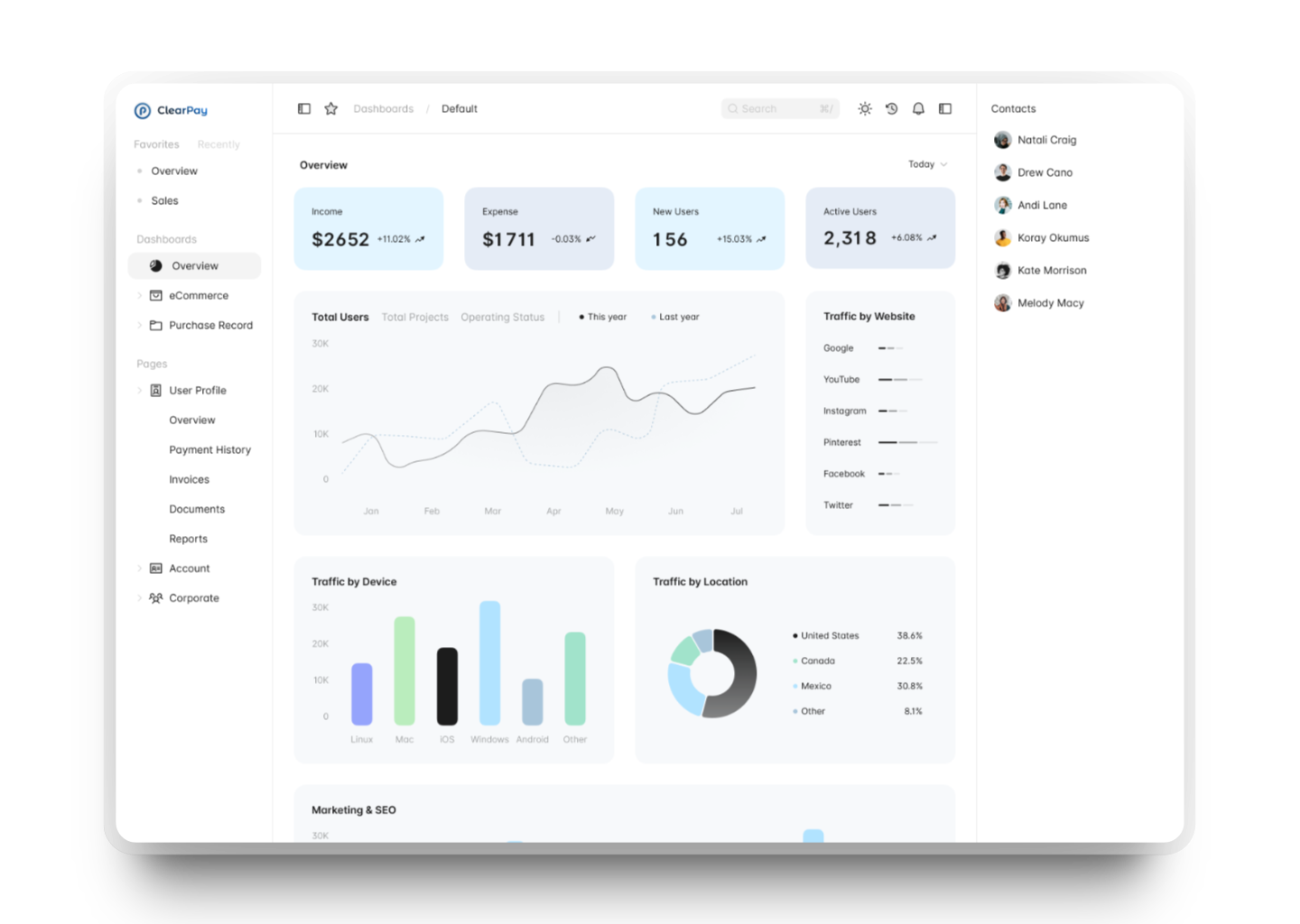

Experience transformative digital banking journeys with ClearPay, revolutionizing financial experiences using advanced technology.

Entrepreneur

"As an entrepreneur, the tools offered by Clearpay's platform have revolutionized my operations, simplifying transactions and facilitating data-driven growth."

Tech-savvy User

"Clear Pay's Dashboard is user-friendly and intuitive, providing easy access to financial data for effortless payouts and invoicing."

Our range of innovative features is designed to make managing your finances easier, faster, and more convenient.

Our advanced security protocols and fraud prevention measures ensure your transactions are safe and secure, providing peace of mind for both you and your customers.

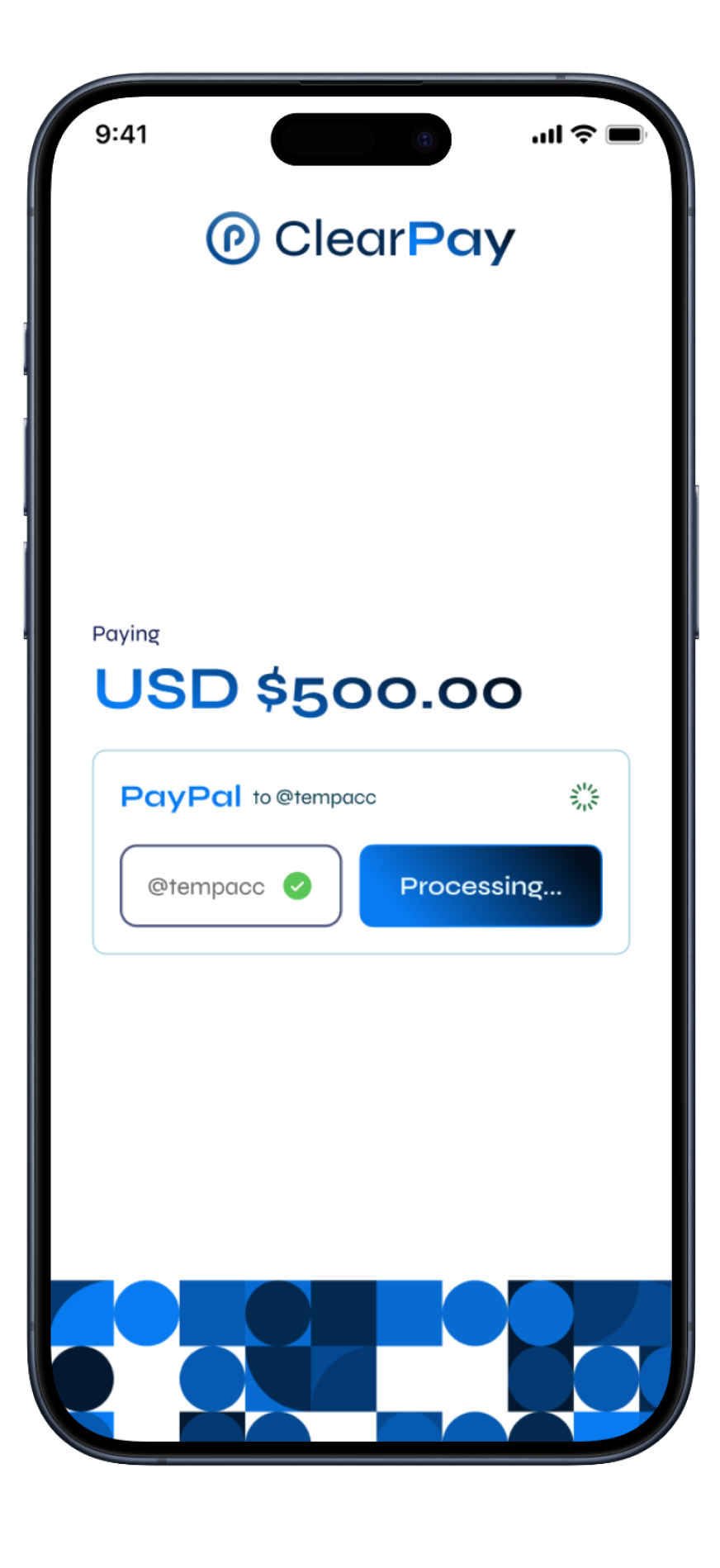

Speed is essential in today's fast-paced business environment. Our solutions ensure that your payments are processed quickly and efficiently, reducing waiting times and improving cash flow.

Our payment solutions integrate seamlessly with your existing systems, making the transition smooth and hassle-free. Focus on what you do best while we handle your payment processing needs.

We make business dreams possible by empowering merchants with the tools they need to process payments effectively and drive growth.

Our vast payments knowledge and expertise support your growth in the face of risk and ensure compliance needs are met.

With Clear Strategic Solutions, you get the one-stop-shop experience, with full support across every payment service. Our mission is to help you succeed!

Discover how modern technologies are changing finance, offering effective, secure solutions for everyone.

A payment gateway is a technology that enables merchants to accept payments from customers via various methods, such as credit cards, debit cards, and online banking. It securely captures and transfers payment information from the customer to the merchant’s acquiring bank, facilitating the transaction process.

A payment gateway works by capturing payment details from the customer and securely transmitting them to the acquiring bank. Here’s a simplified process:

Benefits of using a payment gateway include:

Payouts in a payment gateway system refer to the process of transferring funds from the merchant’s account to their bank account. This involves:

Common fees associated with payment gateways include:

When choosing a payment gateway, consider the following factors:

Payment gateways offer several security measures to protect transactions, including:

Where we navigate the evolving landscape of financial technology, digital banking solutions, and innovative payment systems.

Welcome to WordPress. This is your first post. Edit or delete it, then

Seamlessly manage your payments, process payments smarter, and achieve your financial goals with our cutting-edge solutions.

Powered by Varion Studio

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.